Business Analytics for Translation and Localization: Financial Indicators

Classification and Definition

Financial KPIs are derived from balance sheet components and are decision-support instruments. They show how a business is performing with respect to its goals and how sustainable the business model is through revenues and profits.

Financial KPIs are a business’s health checkup.

Category

Efficiency, productivity, profitability

Definition

Financial indicators come from a combination of different KPIs that mostly relate to a company’s business administration. These KPIs are widely documented and are as follows:

- Gross Profit Margin

A measure of the efficiency of a business in producing its services. This KPI is expressed as the difference between revenue and the cost to provide services divided by revenues. - Net Profit Margin

A measure of the profitability of a business with respect to revenues. It is expressed as the ratio between net profits and revenues, showing the business’s efficiency and ability to control costs. It is also referred to as net income margin or return on sales. - EBITDA

A measure of the profitability of a business calculated by taking sales revenue and subtracting all expenses other than interest, taxes, depreciation, and amortization. - Budget Variance

A measure of the accuracy of budget projections. It is expressed as the difference between standard costs and actual operating costs. - Return on Equity

A measure of the profitability of a business with respect to its equity. It is expressed as the ratio between net income and total equity, saying how well a business uses investments to generate earnings growth. - Sales Growth

A measure of the variation in sales generated over a certain period. It is expressed in percentage as the difference between the results of one sales period and a previous one. - Quotation Conversion Rate

A measure of the success rate (percentage) of converting quotes for business into actual orders. It is expressed as the ratio between the number of successful quotes and the number of quotes submitted. - Profit per Project

A measure of the capacity of a service-based business to achieve profit from the projects it has worked on, expressed as the ratio between the profit of a project and the number of projects executed. - Customer Profitability

A measure of the profit a business makes from serving a customer over a specified period. It is expressed as the difference between the revenues and the costs associated with that customer.

Indicators 1 through 5 refer directly to a company’s profitability and business administration, while indicators 5 through 9 refer to a company’s ability to grow its business, mostly organically. Indeed, Return on Equity is where the border between running and growing a business is.

Rationale

Financial KPIs are needed to measure the profitability of a business and to assess the efficiency of its processes and its productivity. They are especially helpful to trim processes related sales, procurement, and project management.

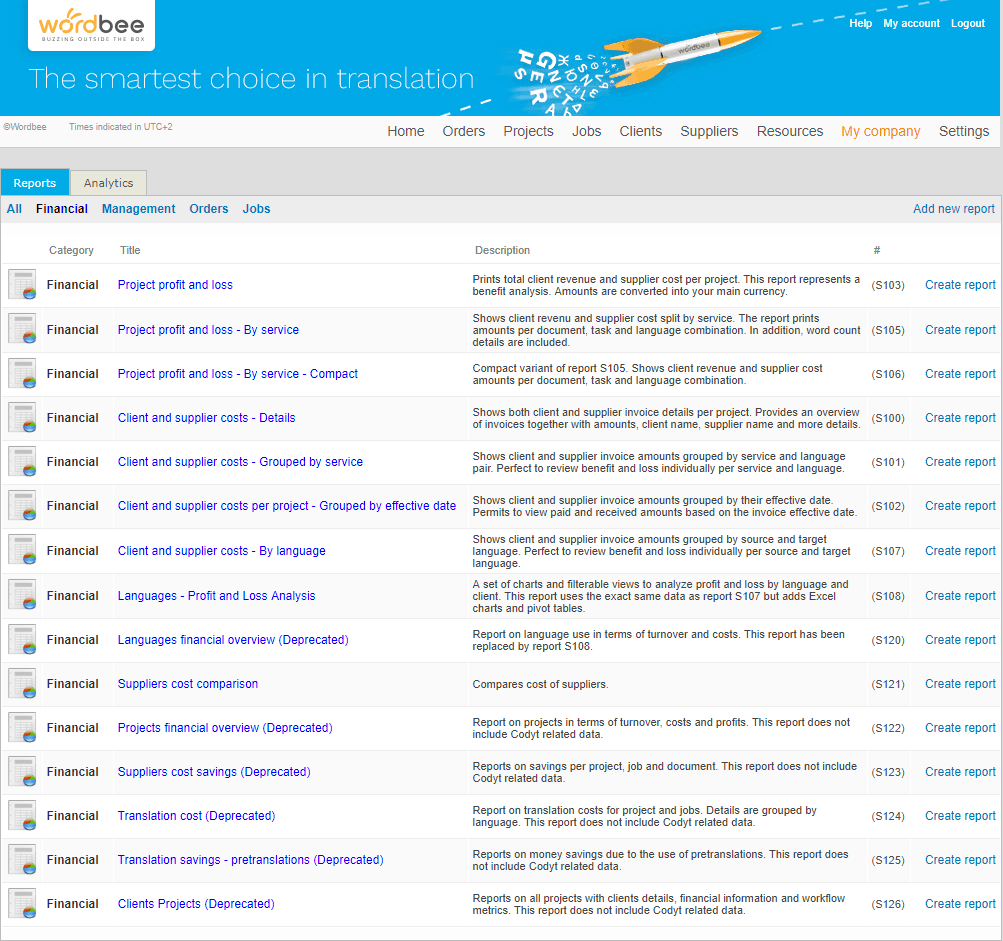

There is no dashboard or immediately available mechanism for such indicators in Wordbee analytics. However, they can be derived from the many reports that Wordbee users may find in the Financial tab from the Reports item of the My company menu.

The Project profit and loss report, for example, collects total client revenue and supplier cost per project, thus offering a benefit analysis, while the Client and supplier costs – Details report provides an overview of both client and supplier invoice details.

Finally, the Languages - Profit and Loss Analysis report presents a set of charts and filterable views to analyze profit and loss by language and client.

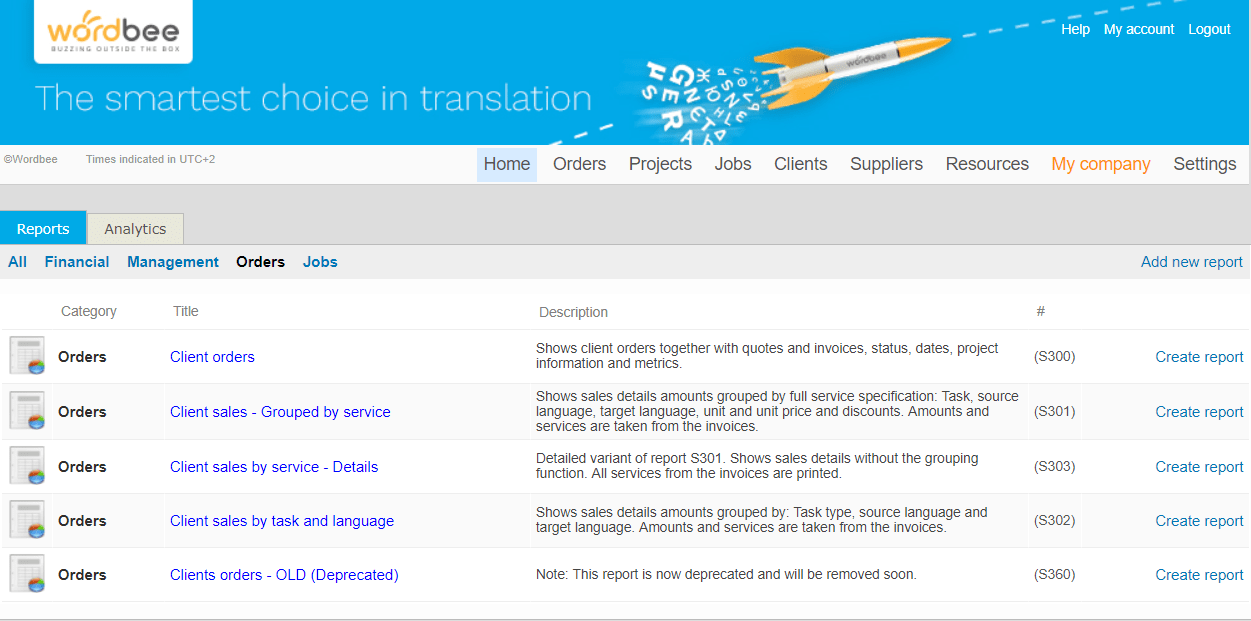

In the Orders tab from the Reports item of the My company menu, Wordbee users can download sales-related reports.

The Client orders report shows client orders together with quotes and invoices, statuses, dates, project information, and metrics, while the Client sales by service – Details report shows sales details without grouping.

Reports are all available in convenient Excel worksheets so that users can aggregate and disaggregate the data collected to derive the indicator(s) of choice.

Impact

Based on the data collected through the Reports, as well as any customized ones, action can be taken to improve performance.

For example, the data available from the Financial Reports will enable you to derive the Net Profit Margin and provide you with an overall idea of your cost control ability: the higher, the better.

Likewise, the data available from the same reports will enable you to derive the Budget Variance to measure your ability to anticipate results; this will improve as more data is available and more accurate analysis and projections can be run.

The data available from the Orders Reports will enable you to reckon a Quotation Conversion Rate to assess how easily your quotes convert into actual orders, thus your ability to formulate winning quotes.

The same data might be used to derive a measure of your ability to increase revenues, thus reduce the risk of being overtaken by competitors and stagnating. The ensuing Sales Growth indicator will be helpful in the formulation and execution of business strategy.

From the data available through project-related Financial reports, the Profit per Project and the Customer Profitability indicators may be derived. The latter specifically will highlight the customer(s) that are worth focusing on, while the former may be used to identify the assignments that are most profitable and should to be sought after.

Usage Advice

You can build your own KPI dashboard to include specific indicators. Many free templates and tutorials are available on the Internet to build a custom Excel-based KPI dashboard.

In any case, just follow these simple steps:

- Gather your data, possibly putting each measure on a different worksheet.

- Highlight the data and select a chart that applies, possibly one from the Insert tab of the top ribbon.

- Copy and paste each chart you build into a separate worksheet that will be the dashboard.

- Resize the charts depending on the importance of each one.

- Replace the data in each worksheet with the new one every time you need to update the dashboard. You can also dynamically “link” the data from your reports to the dashboard worksheet. In this case, remember to save the updated reports in the same place and with the same names as the old ones.

A useful video tutorial for KPI beginners based on Google Sheets is available from Nimdzi Insights’s Managing Director, formerly RWS Moravia’s, Tucker Johnson.

Finally, you might also want to use Wordbee to customize reports to gain different perspectives on data. Most reports can, in fact, be customized in a few steps:

- Click Add new report on the right of the Reports menu to clone an existing report.

- Choose the template from the Reference report dropdown menu; the new report will be based on the same data as the selected report, while you can modify its layout, tables, formulas and charts.

- In the Title box, assign a name to the customized report.

- Download the Excel file to change the current layout and content.

- Click on Upload Excel file or drop it into the dialog window to upload the customized file.

- Press OK to end.

A report template is a standard Excel file containing “placeholders” that will be filled in with the data when you create the report. The list of available placeholders can be found in the documentation page of each default report.

Once done, to finalize your template, you may add some extra formulas for specific calculations, charts, pivot tables, or more sheets as well as your logo and choice of colors and formatting.

Refer to Wordbee’s documentation platform for a list of available business analytics reports and for detailed instruction on how to generate customized reports.

Free Trial

Discover Wordbee Translator with your 15 day free trial or talk to one of our localization consultants.

Is this interesting?

Subscribe to get interesting localization podcasts, discussion panels, and articles every month.